AI in Behavioral Segmentation: 3 Success Stories

AI in Behavioral Segmentation: 3 Success Stories

08-11-2025 (Last modified: 11-11-2025)

08-11-2025 (Last modified: 11-11-2025)

AI is transforming how businesses understand and engage with customers by analyzing behavioral data. Instead of relying on basic demographics, companies can now group customers based on their actions – like purchase habits or browsing patterns – and respond with personalized strategies in real time. Here are three success stories:

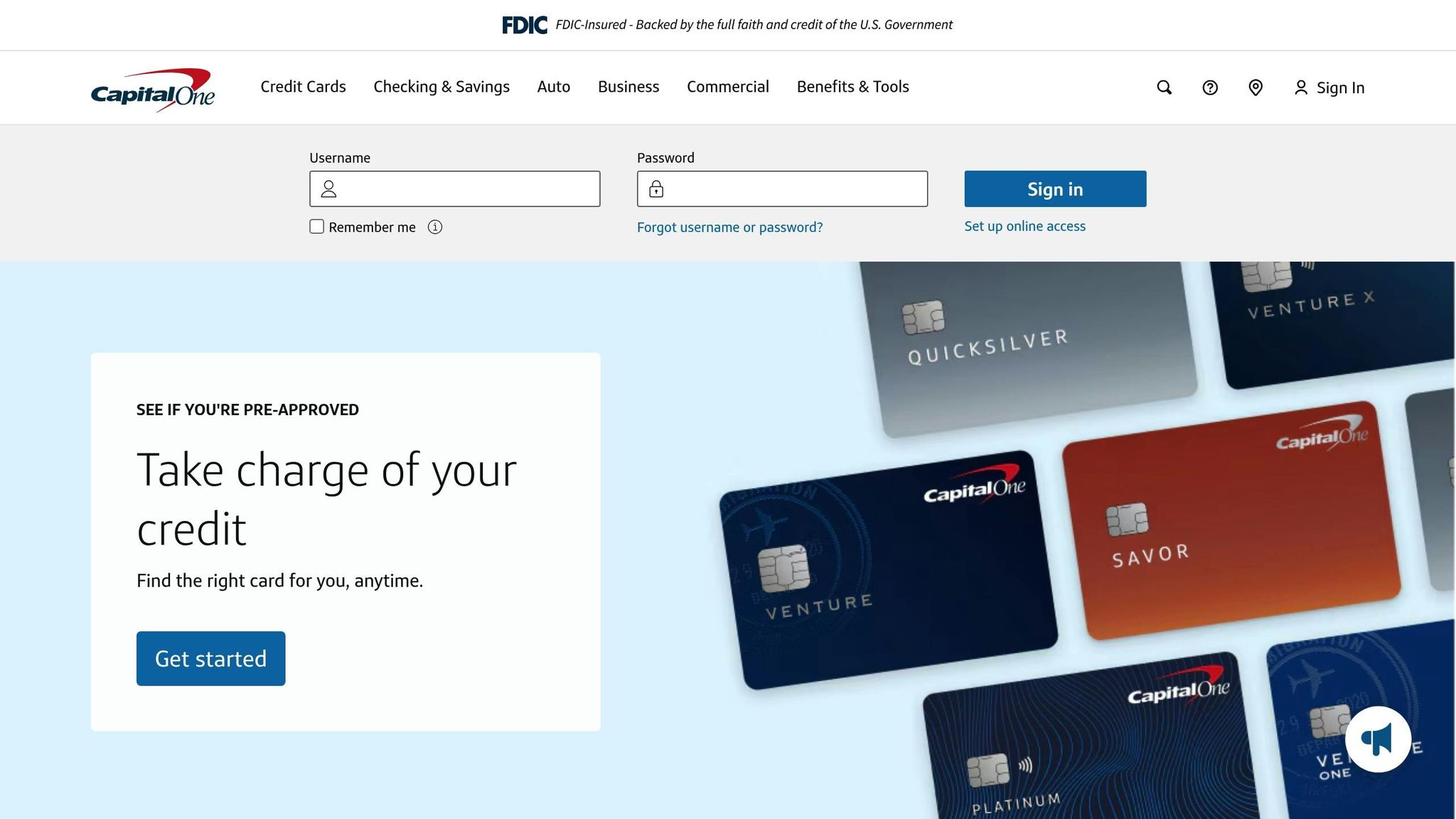

- Capital One: Used AI to refine credit risk assessments, reducing default rates by 25% and increasing customer acquisition by 15%.

- ThirdLove: Enhanced online shopping with its AI-powered FitFinder, providing tailored product recommendations to address customer needs.

- Netflix: Leveraged AI to improve its recommendation engine, increasing watch time by 6% and cutting churn by 4%.

These examples show how AI-driven behavioral segmentation can address challenges and deliver measurable results across industries.

Capital One: Better Risk Assessment and Customer Acquisition

Business Challenge: Balancing Risk and Growth

Capital One faced a tough challenge: growing its customer base while keeping risk under control. Traditional credit assessment methods often fell short. They either dismissed creditworthy individuals with irregular income or limited credit histories or mistakenly approved customers who seemed reliable on paper but turned out to be risky.

For example, customers with variable income or thin credit files were often flagged as high-risk, even if their actual financial behavior showed they were dependable. On the other hand, some individuals who met traditional credit criteria ended up being poor credit risks. Capital One needed a smarter way to evaluate potential customers – one that could dig into deeper behavioral patterns and identify overlooked opportunities for growth.

AI Solution and How It Works

Capital One’s adoption of AI transformed how they assess risk. By analyzing large volumes of behavioral data, the AI system was able to uncover patterns that traditional methods missed. It looked at spending habits, transaction histories, income trends, and even digital interactions to create dynamic, highly detailed risk profiles for each customer.

The system integrates data from multiple sources, including transaction records, payment history, employment details, and spending categories, to build a comprehensive picture of each customer’s financial behavior. For instance, it could identify customers with irregular income who consistently made payments on time, enabling Capital One to extend credit offers to these individuals with confidence.

One standout example: the AI pinpointed a segment of customers with fluctuating income but a track record of reliable payments. This insight allowed Capital One to make targeted credit offers without significantly increasing default risks.

The AI also personalized product recommendations based on behavior. Frequent travelers received offers for travel rewards cards, while budget-conscious users were targeted with low-interest promotions. This level of customization not only improved the relevance of offers but also boosted conversion rates. By leveraging these refined risk profiles, Capital One saw measurable gains in both approval rates and risk management.

Results and Business Impact

The results of Capital One’s AI-powered strategy were impressive. The company achieved a 25% reduction in default rates while increasing customer acquisition by 15%. These numbers highlight how advanced risk profiling, combined with tailored product offerings, can drive meaningful business outcomes.

The AI system also improved marketing efficiency by ensuring offers reached the right customers at the right time. This precision reduced wasted marketing efforts and increased conversion rates across various customer segments. Beyond just growing the customer base, the approach helped maintain portfolio quality, balancing growth with stability.

Capital One’s investment in cloud-based analytics and machine learning paid off, with the benefits far outweighing the costs. For financial institutions aiming to enhance their digital customer experiences, tools like PageTest.AI can complement AI-driven insights by testing and optimizing website elements – headlines, CTAs, and product descriptions – tailored to different behavioral segments. This combination can further refine conversion rates and create a more personalized customer journey.

ThirdLove: Personalizing Customer Shopping Experience

Business Challenge: Improving Customer Experience

ThirdLove faced a common challenge in the intimate apparel industry: high bounce rates and frequent cart abandonment. Since shopping for bras and underwear is highly personal – focused on fit, comfort, and style – customers often browsed multiple times before committing to a purchase. Generic product recommendations only added to the frustration, failing to meet individual needs for size, support, and style. To address these pain points, ThirdLove turned to AI-powered personalization.

AI Solution: The FitFinder Tool

To overcome these hurdles, ThirdLove introduced the FitFinder tool, an AI-driven system that goes beyond basic demographic data. Instead, it dives deep into customer behavior, analyzing signals like page visits, time spent on-site, quiz answers, and fit preferences. For instance, the tool can detect strong purchase intent when a customer visits product pages 10 times in a single week – flagging them as more likely to buy.

The AI also identifies micro-segments that manual analysis might overlook. For example, it can pinpoint customers who prefer sustainable fabrics combined with minimalist designs. With this level of detail, ThirdLove delivers hyper-personalized product recommendations and targeted offers in real time, ensuring they reach customers when engagement is at its highest.

Results from AI-Driven Segmentation

While ThirdLove hasn’t shared exact performance figures, the results align with industry trends. Comparable AI-driven strategies have achieved impressive outcomes, such as a 25% increase in email revenue, a 20% boost in customer retention, and a 15% drop in cart abandonment rates. By uncovering hidden customer segments, ThirdLove has also gained valuable insights for product development and inventory planning, helping them spot untapped market opportunities.

The AI continuously learns and adapts, refining its segmentation to keep pace with changing customer preferences. In addition, tools like PageTest.AI fine-tune website elements based on these behavioral insights, combining personalization with conversion optimization to drive engagement and improve overall performance.

Netflix: Boosting User Engagement with AI Recommendations

Business Challenge: Keeping Users Engaged

In the fiercely competitive U.S. streaming market, Netflix had to tackle a critical problem: keeping its vast subscriber base engaged. With an extensive content library, many users experienced “choice paralysis”, making it harder for them to decide what to watch. This often led to frustration and, in some cases, cancellations. As competition in the streaming space grew, Netflix needed a way to ensure users stayed entertained and loyal. That’s where AI came into play.

AI-Powered Recommendation System

To address this challenge, Netflix developed a cutting-edge AI recommendation engine designed to understand users on a deeper level. By analyzing a range of behaviors – like viewing history, watch time, search habits, device preferences, and even the time of day they watch – Netflix’s system creates highly detailed user profiles. These profiles allow the platform to group users into dynamic segments based on their preferences and watching patterns, delivering hyper-personalized recommendations.

One standout feature of this AI system is its ability to personalize not just content suggestions but also visual elements, such as thumbnails and artwork, tailoring them to individual tastes. In 2023, Netflix’s AI team, led by Director of Machine Learning Tony Jebara, introduced an upgrade that incorporated real-time engagement data. This enhancement allowed the recommendation engine to adapt more quickly to users’ changing habits, significantly improving the relevance of its suggestions.

Impact on User Engagement and Revenue

Today, Netflix’s AI recommendations account for over 80% of the content consumed on the platform, making them a cornerstone of user engagement. The 2023 algorithm update brought measurable results: a 6% increase in average watch time per user and a 4% drop in monthly churn over six months. These improvements directly boosted Netflix’s bottom line by increasing customer lifetime value.

The financial benefits are enormous. By reducing churn and improving retention, Netflix’s AI-driven personalization reportedly saves the company around $1 billion annually. With a customer retention rate of approximately 93% in the U.S. – one of the highest in the streaming industry – Netflix has set a gold standard for how AI can enhance user satisfaction and loyalty.

Beyond engagement, the insights from the recommendation engine have reshaped Netflix’s content strategy. Data from the system influences decisions on which original shows and movies to produce, ensuring they resonate with audience preferences.

For other businesses aiming to replicate Netflix’s success, tools like PageTest.AI offer a way to optimize user experiences. By analyzing behavioral data, companies can test and refine how they present content – just as Netflix continually evolves its recommendation algorithms to keep users hooked.

sbb-itb-6e49fcd

How to Implement AI-Driven Behavioral Segmentation

Implementation Steps

Start by setting clear business objectives. Are you aiming to boost conversions, lower churn rates, or increase customer lifetime value? Without well-defined goals, even the smartest AI tools won’t deliver the results you’re after.

Next, gather and unify data from all customer touchpoints. This includes everything – website visits, clickstreams, purchase history, product views, email interactions, and real-time activity. Consolidating this data into a single view is essential for seamless analysis.

Choose AI models that align with the complexity of your data. For simpler segmentation, clustering models work well. For more intricate patterns, deep learning models are the way to go. Industry leaders have used these approaches to significantly improve conversion rates and click-through performance.

Set up real-time monitoring with automated dashboards to keep tabs on segment performance. Track engagement and conversion metrics, and establish feedback loops to refine your models as new data is collected. Companies like Capital One and Netflix excel by using such adaptive strategies.

For businesses testing different content across behavioral segments, tools like PageTest.AI can help. These platforms allow you to experiment with AI-generated content variations tailored to specific segments.

Finally, ensure your approach includes a strong focus on data privacy to make your segmentation efforts sustainable.

Data Privacy and Compliance Requirements

Privacy isn’t just a legal requirement – it’s key to building trust. Adhering to regulations like GDPR and CCPA means obtaining clear, explicit consent from users before collecting behavioral data. This involves creating easy-to-understand opt-in mechanisms and being transparent about how the data will be used.

Data anonymization is another critical step. By removing or encrypting personally identifiable information, you can protect customer identities while still allowing valuable analysis. Regular audits are essential to spot and address any privacy risks early.

Transparency is your ally. Clearly written privacy policies that explain what data you collect, how it’s used, and what control customers have over their information build trust with both users and regulators.

Taking it a step further, ethical AI practices ensure that segmentation models don’t unintentionally reinforce biases or discriminate against specific groups. Regular testing and validation can catch these issues early, and diverse development teams can help identify potential problems before they escalate.

Collaboration across teams – legal, data science, and marketing – ensures privacy considerations are baked into your strategy from the start, not added as an afterthought.

With privacy in place, the next step is to create an infrastructure that supports your segmentation efforts.

Building the Right Infrastructure

A scalable infrastructure is the backbone of effective AI-driven behavioral segmentation. As your data grows, you’ll need robust computational resources, such as scalable cloud storage and high-performance processing. For deep learning tasks, GPU acceleration is essential for handling complex analyses in real time.

Your data pipeline should support the continuous flow of information from multiple sources. This includes real-time streaming for instant updates and batch processing for analyzing historical trends.

Seamless integration with your existing systems is crucial. Your segmentation tools should connect easily with email platforms, advertising systems, and content management tools to deliver personalized experiences automatically.

Automation is key. Modern behavioral data moves too fast and in too large volumes for manual analysis to keep up. Invest in systems that can identify new segments, detect behavior shifts, and adjust targeting strategies on their own.

Consider starting with a progressive adoption approach. Begin with simple behavioral triggers and gradually move to advanced AI models as your infrastructure and team expertise grow. This method reduces complexity and allows you to demonstrate early successes, making it easier to justify further investment.

Cloud-based solutions are often a cost-effective way to access scalable AI tools. A strong infrastructure is the foundation for the adaptive strategies that drive success in behavioral segmentation.

Conclusion

Summary of Success Stories

The three examples highlight how AI-driven behavioral segmentation can tackle business challenges and turn them into competitive strengths. Capital One reshaped risk assessment by analyzing customer behaviors, enabling more precise credit decisions and tailored offers. This approach balanced growth with responsible lending. ThirdLove revolutionized online shopping with its AI-powered FitFinder, using behavioral data to deliver personalized sizing and product recommendations. This not only reduced returns but also elevated customer satisfaction. Meanwhile, Netflix utilized AI to study viewing patterns, delivering highly relevant content suggestions that kept users engaged and minimized churn.

What ties these companies together? A commitment to leveraging real-time behavioral insights. Their achievements illustrate how AI segmentation delivers measurable benefits across industries.

Another key takeaway is that success doesn’t require massive overhauls. These companies started with clear goals and gradually expanded their AI capabilities. This step-by-step approach allowed them to achieve early wins while laying the groundwork for more advanced segmentation strategies. Their journeys set the stage for even more dynamic applications of AI in the future.

The Future of AI in Behavioral Segmentation

Looking ahead, AI-driven segmentation is entering an exciting new phase. The focus is shifting toward predictive, real-time personalization. Businesses can now anticipate customer needs before they’re even voiced, identifying at-risk segments and delivering proactive solutions to increase engagement and reduce churn.

As AI becomes more accessible, its ability to deliver hyper-personalized, real-time content continues to grow. Tools like PageTest.AI are leading this charge with no-code solutions that help businesses optimize website content using behavioral data. These platforms generate content variations, track performance metrics like clicks and engagement, and provide actionable insights – all without requiring technical expertise.

Users are already seeing the benefits:

“Love this product, it means we get the most from our site’s traffic. Knowing we can test every call to action and optimize our SEO efforts is very satisfying.” – David Hall, CEO, AppInstitute

The future promises even more personalized experiences. AI will uncover customer segments that might go unnoticed by human analysts, enabling businesses to craft precise strategies. Real-time triggers, like cart abandonment, will prompt immediate, tailored responses.

As AI models advance, expect seamless integration across all marketing channels, blending online and offline customer experiences. Businesses that start now – using basic behavioral triggers and gradually adopting more advanced AI tools – will be well-positioned to seize the growing opportunities in behavioral segmentation.

How Does Behavioral Segmentation Improve Audience Targeting? – Marketing and Advertising Guru

FAQs

How is AI-driven behavioral segmentation different from traditional demographic-based marketing segmentation?

AI-driven behavioral segmentation zeroes in on real-time user actions, preferences, and patterns, grouping customers based on how they behave – whether it’s their browsing habits, purchase history, or engagement levels. In contrast, traditional demographic-based segmentation relies on fixed attributes like age, gender, income, or location to categorize audiences.

What sets AI-driven behavioral segmentation apart is its ability to continually adjust to changes in user behavior. This lets businesses offer tailored experiences and deliver content that feels more relevant to individual users. The result? Often, it leads to better engagement and higher conversion rates compared to the broader insights provided by demographic-based methods.

What challenges do companies face when using AI for behavioral segmentation, and how can they address them?

Implementing AI-powered behavioral segmentation isn’t always smooth sailing. Companies often face hurdles like integrating AI tools into their existing systems, managing the quality of their data, and safeguarding user privacy. If these issues aren’t addressed, they can weaken the impact of segmentation efforts.

To tackle these challenges, businesses should prioritize selecting AI tools that align with their current infrastructure and invest in thorough training for their teams. Keeping data clean and well-structured is essential for reliable AI predictions. Additionally, adhering to privacy laws such as GDPR or CCPA is key to earning and maintaining customer trust. Starting with smaller, controlled tests can also help refine the process before expanding on a larger scale.

How can businesses protect user data and stay compliant when using AI for behavioral segmentation?

To protect user privacy and ensure compliance, businesses should follow essential practices when using AI for behavioral segmentation.

- Follow data protection laws: Abide by regulations like GDPR or CCPA by gathering only the data you truly need, securing user consent, and providing straightforward privacy policies.

- Anonymize data: Strip or mask personally identifiable information (PII) from datasets to reduce privacy risks while still gaining meaningful insights.

- Choose reliable platforms: Opt for AI tools that emphasize security, offer transparent data handling, and align with industry standards for safeguarding information.

By adopting these practices, companies can harness AI’s potential responsibly, respecting user privacy and staying within legal boundaries.

Related Blog Posts

say hello to easy Content Testing

try PageTest.AI tool for free

Start making the most of your websites traffic and optimize your content and CTAs.

Related Posts

16-02-2026

16-02-2026

Ian Naylor

Ian Naylor

How Cognitive Load Impacts Conversion Rates

Reduce cognitive load with simpler layouts, clearer CTAs, and fewer choices to cut friction, improve UX, and lift conversion rates—backed by tests and metrics.

14-02-2026

14-02-2026

Ian Naylor

Ian Naylor

Ultimate Guide To SEO Conversion Metrics

Measure how organic traffic converts into leads and revenue. Learn key metrics, GA4 setup, Value Per Visit, CLV, and optimization tactics.

12-02-2026

12-02-2026

Ian Naylor

Ian Naylor

SEO Content Optimization Planner

Create search-friendly content with our SEO Content Optimization Planner. Get a custom plan to rank higher—try it free today!